No matter which area of expertise we’re talking about, a significant number of freelancers struggle to maintain a steady cash flow. There are different reasons why this can be the situation. For some freelancers, there are never enough clients who provide a steady income, while for others – the amount they’re paid is simply not enough. Maintaining a steady freelancer’s cash flow requires taking a few simple actions. Planning the budget, keeping track of the invoices, and readjusting rates are just some of them. If you are working remotely and on your own terms, you should keep reading the following article. Here are some simple ways freelancers can maintain a healthy cash flow.

Making a financial plan

Saving money is relative, so everyone makes a plan that works for themselves. However, making a financial plan could be even more important for freelancers, since maintaining a steady income is difficult. If you are a freelancer, you should try to keep track of your monthly expenses and decide how much money you should put aside. For example, you can calculate the cost of rent, utilities, food, and transportation and see how much you will need for basic living costs. This will be the best way to know how much money can be spent on additional costs. Since a freelancer’s cash flow can vary throughout the year, it’s better to have a financial plan and leave some money aside for rainy days.

Keeping a record of regular income

One of the best ways to rely on steady income is to keep track of your finances. Having a record of previous payments and future invoices helps freelancers organize their income. Further, this is also a good start for planning taxes and some unexpected costs. No matter how many clients you are expecting to pay up, it’s always good to plan and analyze how much you earn and spend. You can make a monthly record of the cash flow, create a sheet for your upcoming invoices and compare your monthly income.

Adjusting rates according to the number of working hours

Different clients mean different job descriptions, right? Whether you are a writer, a developer, or a designer, not every project you get will take the same number of hours. Some freelancers charge per hour, but most of them agree on the amount of money for a finished project. The overall goal is to get paid for the amount of work you put into a project, which is why you should choose your clients carefully. Not all projects pay off in the end, especially if you consider the opportunity cost.

If you realize that you’re spending more time handling your daily tasks than usual, there is an easy way to maintain a steady income. All you need to do is adjust your rates for future clients. After all, if you are a freelancer in high demand, why not raise your rates accordingly?

Keeping track of the invoices

Unfortunately for some freelancers, payment delays can happen very often. In order to maintain a steady freelancer’s cash flow, it’s important to schedule invoices in advance and keep track of them. Sending them out on time helps clients organize their payments and transfer money before the due date. If you want to rely on a certain income, this part of planning your finances will be important.

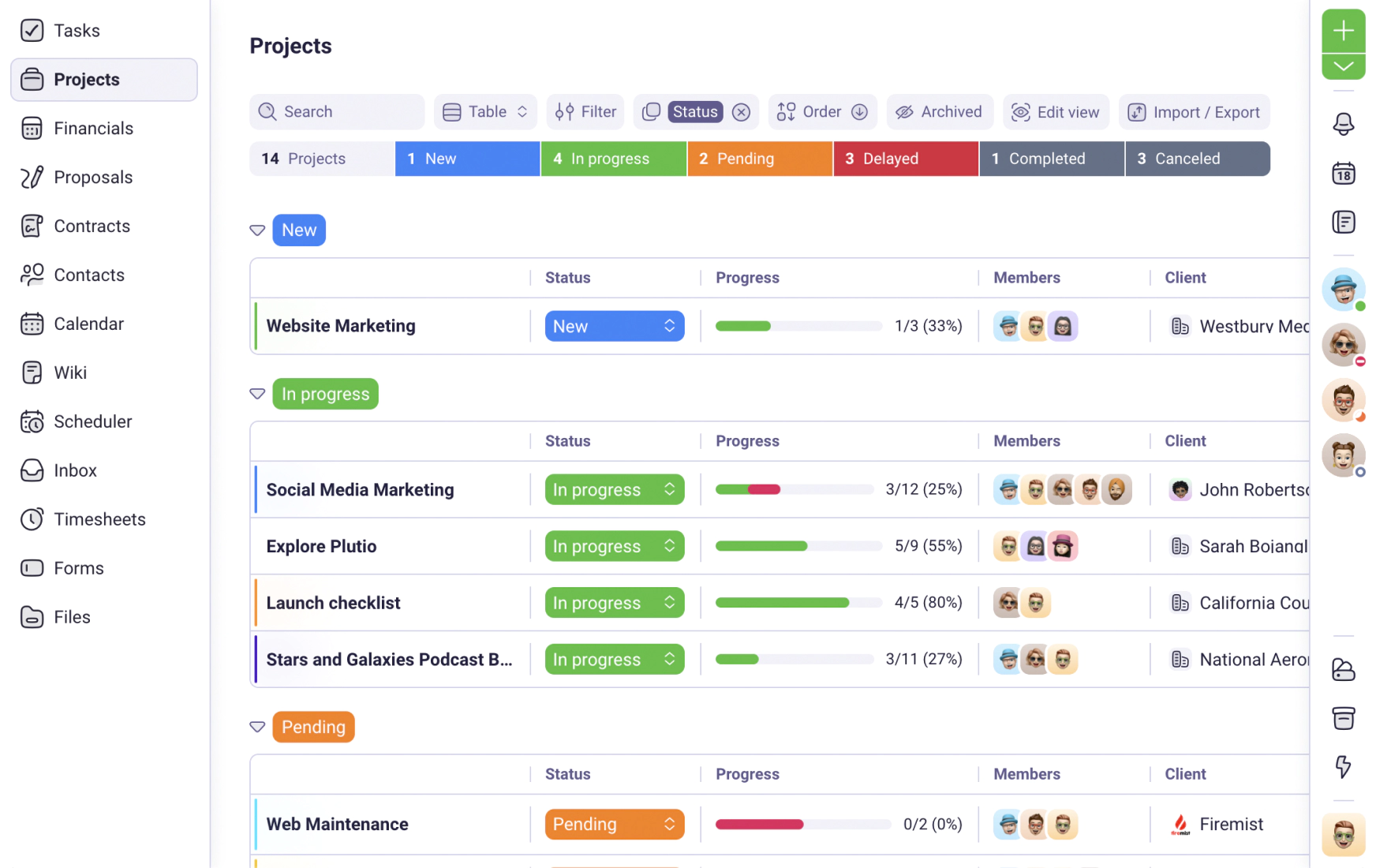

Investing in software programs for finance tracking

Speaking of finance, there are plenty of ways to organize and track monthly incomes and expenses. A healthy cash flow often depends on good organizing skills. This is why many freelancers rely on different software programs to help them manage and track their finances. These programs can sort out your invoices, keep track of the cash flow and remind you of important dates. More importantly, programs for finance tracking are great for saving valuable time at the end of the month.

Budgeting can be the best solution

In order to maintain a freelancer’s cash flow, plenty of them consider budgeting and putting some money aside. For those who can’t expect regular income, this can often be a life-saving solution. For example, if you just finished a few months project and got paid, consider using just some of the money you’ve got. In case you get less work in the next few months, budgeting will help you secure your income and have enough “for rainy days”. Here are some simple ways you can stay on budget and maintain a regular cash flow.

- Make a list of important expenses. As a freelancer, you might need to keep track of your basic living costs. The amount of money you’ll need will be similar every month, but your income might not.

- Estimate your monthly income. Working for a few different clients could mean payments at different times. If you estimate how much you can earn monthly, you will know how to plan your budget. Also, this will help you organize your work hours and decide whether you need to look for more clients.

- Decide on the ways you can save. Budgeting is a good idea in anyone’s life, but it’s especially true for freelancers. If you can cut down on some costs, you will have secure cash until the next payment arrives.

- Make a statistic of your past payments. Whether you’re working by the hour or by the project, this can be a good idea. If you calculate how much you earned in the previous few months, you will get a bigger picture of your income. Further, this statistic will help you organize your finances better.

Steady freelancer’s cash flow - looking for new clients

A freelancer’s cash flow is often unsteady, but so is the amount of work they can find. This is why freelancers often look for clients at all times. In case they have too much work already, there is always an option of choosing projects with further deadlines. For those who don’t have a long-term contract, looking for new clients is usually the best way to secure a steady cash flow.

Besides managing their finances, freelancers are also responsible for managing their own working hours. Handling two or more projects at a time can be difficult, but it can be a better way to maintain a healthy cash flow. In case one client decides to pull back, others will be there to provide the income a freelancer relies on. This is why it’s never a bad idea to start looking for different projects and new clients to work with. If you are a freelancer and want to maintain a steady cash flow, we hope these tips will help you organize your income more successfully. Remember, “time is money”, and this saying applies to freelancers for a good reason. Good planning and a few different sources of income are the best for maintaining a steady freelancer’s cash flow.